Home, property and business owners in Saskatoon could see an 8.23 per cent property tax increase in 2026, along with a 5.95 per cent property tax increase for 2027, according to the latest figures from the city’s chief financial officer.

“This would be equivalent to a $16.20 monthly increase in 2026, and a $12.67 per month increase in 2027 for the median assessed property owner,” Clae Hack said on Thursday.

Read more:

- Temporary warming centre opening Friday, with only days notice

- Saskatoon bridges and streets being decorated for festive season

- Saskatoon councilors consider options for dedicated police transit officers

This year, the median assessed home and property value in Saskatoon rose to $394,200.

The latest numbers are down slightly from initial projections presented in early June, which indicated a 9.9 per cent hike in 2026 followed by a 7.3 per cent hike in 2027.

Hack said 70 per cent of the city’s spending consists of funding the police and fire department, along with transportation, transit services and corporate costs like IT, human resources and finance. He said population growth and inflation have also affected budget considerations.

“From 2022 to 2024, our city added 25,000 people; more than the populations of Humboldt and Yorkton combined,” he said.

Another 9,000 new residents are expected to make Saskatoon their home this year.

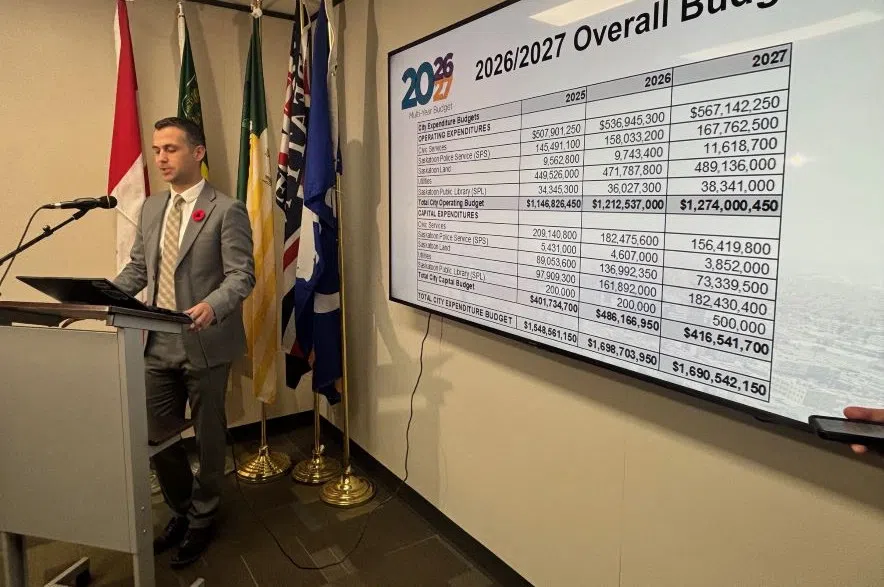

The overall budget projected for 2026 and 2027 is now nearly $1.7 billion for each year, including $1.2 billion for operational spending and nearly $500 million for capital costs.

The biggest operational costs include civic services, Saskatoon police service, Saskatoon land department, utilities, and the Saskatoon Public Library.

In 2026, the police force has requested a budget increase of $12.5 million, while the fire department is requesting another $5.6 million.

Hack said while the numbers are high right now, he is confident they can be lowered somewhat, with new budget information and scenarios to be presented to council closer to the start of budget deliberations later this month.

“This report will present over 100 options and budget levers for city council to consider, to reduce the property tax requirement,” he explained.

Recent budget additions – like a potential $8.6 million over two years in the city’s newly adopted affordable housing strategy, $300,000 for a team of Indigenous transit peacekeepers, $1.6 million over one or two years for a dedicated police transit police team – and any potential cost overruns associated with renovations at a temporary women’s shelter scheduled to open on 23rd Street East on Friday, are not included in the 2026 budget projections.

“A lot of those conversations that have been happening over the last couple of weeks, city council would need to add that funding and those resources at budget time if those programs were to proceed,” said Hack.

Hack says it’s possible that the final property tax increase will land in the 4.9 per cent range for 2026 and 2.34 per cent in 2027. He said council will “have those levers to pull” in the coming weeks.

“The options that will be presented to council are going to touch on a couple different things, so changes to our rate structure, taking on additional risk (and) service level reductions or changes,” he added.

The budget agenda will be released on Nov. 19, while budget deliberations will take place from Nov. 25-27.