This story was first published on RealAgriculture.com on Oct. 2, 2025.

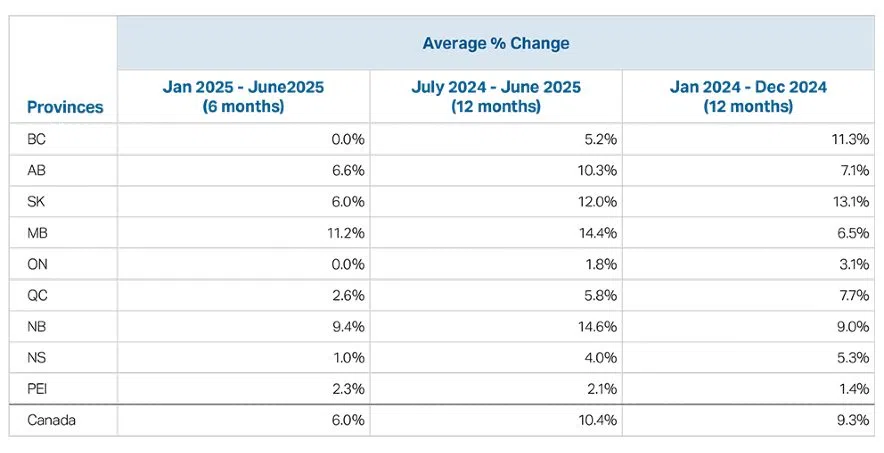

Farm Credit Canada has published its 2025 mid-year farmland values report, with a mixed-bag of changes to cultivated acres in Canada. While farmland values grew an average of 6 per cent in the first half of 2025, the average doesn’t tell the full story.

Read more:

- New website delivers advanced tools and data for pulse crop producers

- Sask. adds elk hunting opportunity in effort to limit crop damage

- Sask. producers make good progress, 84 per cent of harvest complete

In looking at the provincial numbers, the country splits neatly at the Manitoba/Ontario border, with the biggest gains in the west and none or only modest growth in the east. The numbers reflect only the first half of 2025, however, B.C. and Ontario posted a goose egg — a sign of falling fortunes in the agriculture sector.

Over the 12 months from July 2024 to June 2025, there was a 10.4 per cent increase, representing a slight increase compared to the previous 12-month period (January to December 2024) with a 9.3 per cent increase. But the trend of growth is slowing.

(Farm Credit website)

Manitoba led the country with an 11.2 per cent increase, followed by New Brunswick (9.4 per cent) and Alberta (6.6 per cent). Saskatchewan matched the national average at 6.0 per cent, while Quebec (2.6 per cent), Prince Edward Island (2.3 per cent), and Nova Scotia (1.0 per cent) posted modest gains, with Ontario and British Columbia recording a “no change.”

“Demand for farmland remained strong in the first half of the year regardless of lower commodity prices,” says J.P. Gervais, FCC’s chief economist.

“Buyers continued to invest, driven by long-term confidence in the agriculture sector and the limited supply of available land. While growth is uneven across provinces, the overall trend points to promising growth opportunities in agriculture.”

Despite notable gains in certain regions, over the past six months, the overall range of sale prices per acre has increased only modestly. Provinces that experienced strong growth in recent years are now seeing a softening in farmland prices, the Crown corporation says, while regions with previously more modest increases continue to see solid gains. Overall, the market appears to be stabilizing, says FCC.

Gervais notes that farm cash receipts fell 1.6 per cent in 2024, mainly due to a drop in grain and oilseed revenue, while livestock receipts rose. Looking forward, receipts for grains and oilseeds are expected to decline overall in 2025 by 6 per cent.

“The interplay between interest rates, farm revenues and expenses, and constrained land availability will continue to shape the trajectory of farmland values,” Gervais says.

Listen to RealAg on the Weekend, Saturdays at 4 p.m. and Sundays at 1 p.m. on 650 CKOM and 980 CJME.

Read more: