If U.S. tariffs weren’t enough, Saskatoon businesses may now have to contend with higher taxes as well.

The city is proposing a 9.9 per cent property tax hike for businesses in 2026, followed by a 7.3 per cent increase in 2027.

But local business owners aren’t taking it lightly.

Read more:

- Saskatoon financial forecast projects 9.9 per cent property tax increase in 2026, 7.3 in 2027

- Saskatoon mayor to review conditions allowing controversial MAGA Christian singer’s concert

- Rotary Garden Community Collective evicted from city property

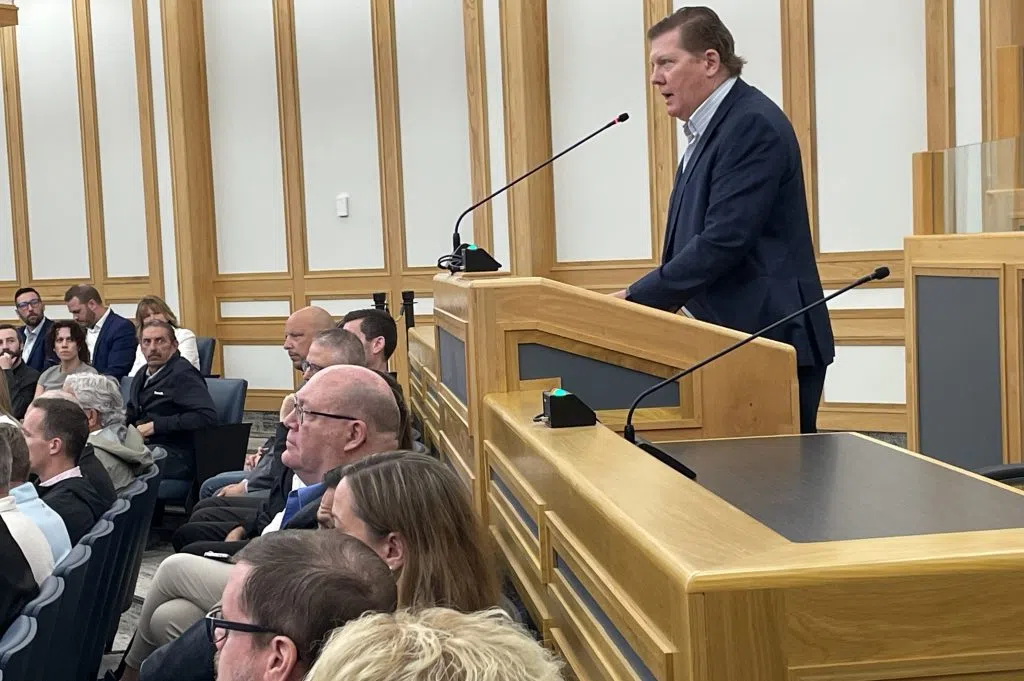

Dozens came to city hall for the governance and priorities committee meeting on Wednesday, occupying roughly two thirds of the council chambers’ seats.

“I was pleased with the turnout, considering it’s mid August,” said Keith Moen, executive director of the North Saskatoon Business Association.

The demonstration was intended to make a point to city council about the potential tax increase, which outpaces inflation. The current rate of inflation is 1.9 per cent, according to the Bank of Canada.

Ken Cenaiko, with Croatia Industries, said local businesses are opposed to the proposed tax hikes, and want city hall to accept the challenge of reducing taxes instead of raising them.

“Sometimes it feels like, you know, there’s a semi truck screaming down the highway and we’re standing in the middle of it, combing our hair,” he said.

Moen said he thinks council heard the message, but he couldn’t say whether anything will come out of it.

NBSA Executive Director Keith Moen said finding ways for the city to reduce costs, “almost always boils down to workforce and the staffing levels.” (Marija Robinson/650 CKOM)

Reducing staff could prevent tax hike

Moving forward with the proposed increased taxes could force some businesses to close.

“Depending on where a business is at, you might not have that big of a margin year to year to be able to make it through with that nine per cent increase,” said Colton Wiegers, of Wiegers Financial & Benefits.

Moen echoed Wiegers’ comments, saying some businesses will shut their doors because they can’t afford the overhead costs.

“It’s the pebble in the backpack theory, where the next little one will be the one that brings the person down,” Moen said.

Some businesses, like Croatia Industries, are already carrying the weight of tariffs over the last eight months.

“We have all those challenges dealing with the tariffs. It’s hard to, on top of that, have tax increases as well,” Cenaiko said.

There are solutions, though, that could avoid the property tax hike. In his speech during the committee meeting, Moen said the city should take a deeper look at its staffing levels.

“Once a position is created, it rarely disappears, and with it comes not just a salary, but ongoing benefits and pensions that last for decades,” he said.

So, rather than counting on businesses to offset costs, Moen said council could consider limiting new hires, reducing staff in certain departments by 10 per cent, discontinuing programs meant to be funded by higher levels of government, and using AI more frequently.

He said his recommendations are based on work done by the North Saskatoon Business Association’s tax committee.

Moen didn’t provide exact details on what positions could be cut, but he said that’s not his responsibility. He said it’s up to council and administration to find those opportunities – and fast.

“We need to see bold action, starting now,” he said.