The value of residential properties on average is down in Saskatoon by about seven per cent, while the value of a typical commercial property value went up about eight per cent.

Bryce Trew, Saskatoon’s city assessor, says property values aren’t reflective of what has happened over the past year in the real estate market or of the average price of a property in 2020.

Unlike most Canadian provinces except for Ontario, Saskatchewan doesn’t do assessments on a yearly basis. They’re only done every four years. The last reassessment was in 2017, with a base date of Jan. 1, 2015.

“The base date (this year) is Jan. 1, 2019,” Trew said. “With assessments in Saskatchewan, we’re always working from behind a few years in terms of where we’re trying to develop market values. So any changes that have occurred in the market between Jan. 1, 2019 and today aren’t reflected in your property assessments.”

He says while COVID-19 in the last year possibly affected property values, it’s not reflected in the current notices going out to property owners.

Some may wonder as well that if their property assessments have gone down, why aren’t they paying less in taxes? Trew says it’s a matter of how your property compares with others in the same class as you.

The tax part, he says, is set by the city budget, which is done on an annual basis. The assessment part is determining how the property taxes get divided, and who pays what portion of that property tax.

Trew explains there’s a particular ratio assessors look at when collecting from the residential class and the commercial class.

“You need to look at how much your property assessment dropped in comparison to other properties within that property class,” he said. “So if everything in that residential class dropped seven per cent, you need to use that line of comparison.

“If your assessment dropped more than that seven per cent, you would see a decrease in your taxes. If your assessment didn’t drop or was minus two per cent or anything above that seven per cent, you would see an increase in property tax.”

He says going back to 2017 and 2013 when assessments were raised, the city didn’t collect more taxes because values went up. It had to adjust the mill rate to collect the same amount of property tax as set by the budget.

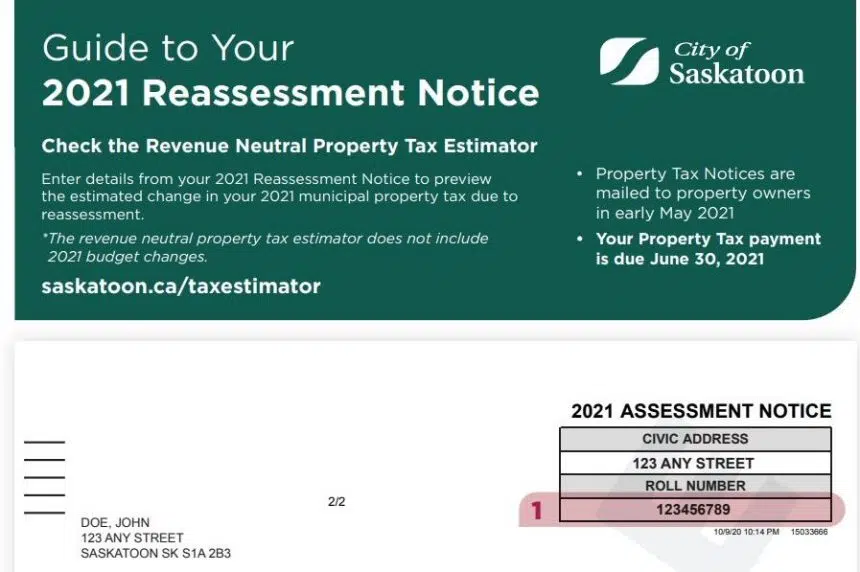

Trew says property owners have until March 29 to review their assessment and determine if they feel it’s correct or if they need to file an appeal.

“Use our website, validate the characteristics of your property (and) make sure you feel your assessment is right,” he said. “If you feel that there’s something wrong, contact our office.”

For more information, contact the City of Saskatoon.