While the federal government has moved to lower taxes on small businesses, some owners remain skeptical on what lies ahead.

Spencer Early owns Early’s Farm and Garden Centre in Saskatoon and is a member of the North Saskatoon Business Association (NSBA). He said while the change is probably good news, he still has concerns.

“They’re basically throwing a carrot out to the business community to look good, but they already look so bad. There’s very little that they could do now to make themselves look good,” Early said.

Prime Minister Justin Trudeau announced Monday the tax will be lowered to ten per cent by January, and will go down to nine per cent in 2019.

The small business tax rate is currently at 10.5 per cent and applies to the first $500,000 of active corporate income. The government said lowering the rate will provide entrepreneurs with up to an additional $7,500 per year.

“We don’t object to paying taxes. What we object to is the way that they are spent,” Early said.

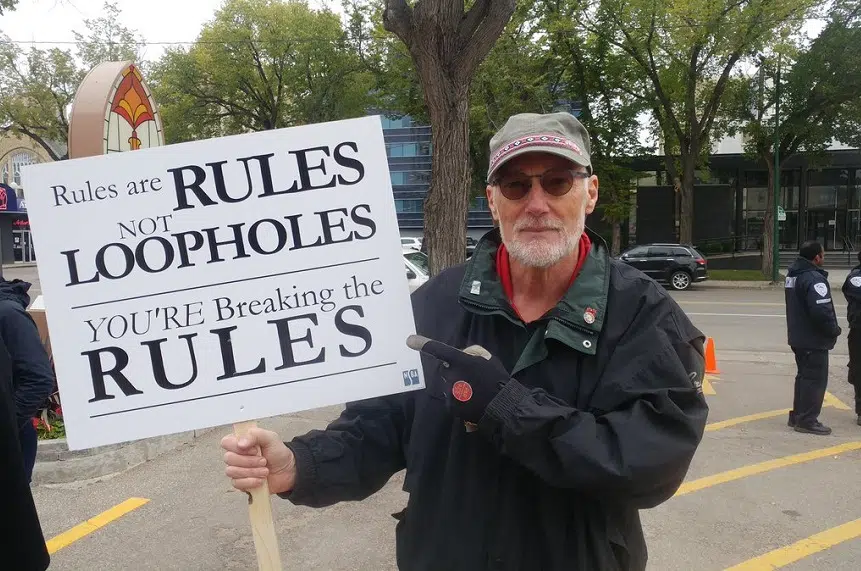

In September, the NSBA held an hour-long rally against the federal government’s previously proposed tax changes towards small businesses.

On Monday, Trudeau said the government would simplify one of its more contentious proposals, which would limit the ability of business owners to lower their personal income taxes by sprinkling their income to family members who do not contribute to their companies.

Early said the change to income sprinkling will still impact his business.

“There has to be risk and reward, and if there is no reward, then why take the risk?” Early said. “You might as well just go get a normal job with guaranteed income and a guaranteed pension and call it a day.”

While Early’s family business is in its 110th year of operation, the owner highlights there is no job security in his industry.

“A lot of people who have government jobs, and teachers and those kinds of people, they’re guaranteed a job for life and they’re guaranteed a pension at the end of the day — we have none of that,” Early said.

Early said he is now waiting to see the entire program from the federal government before making any more changes.

Combined, the government estimates the tax reductions will reduce Ottawa’s revenues by about $2.9 billion over five years.

— With files from The Canadian Press.